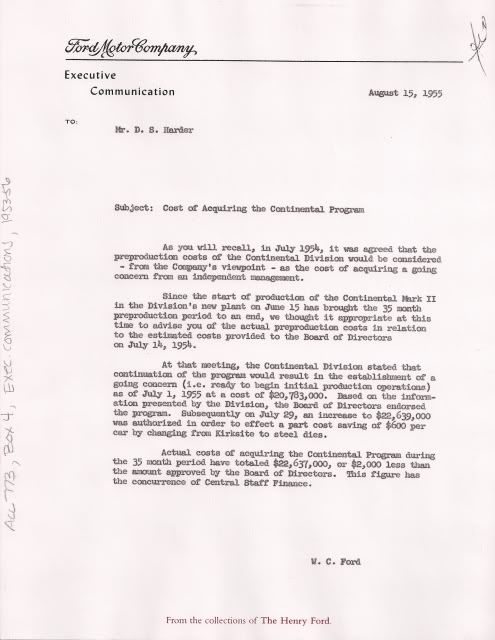

Cost of acquiring the Continental Division.

Cost of acquiring the Continental Division.

As we all know, the fledgling Continental Division started off as the Special Products Division of Ford Motor Company developed at the Ford Trade School, just Northeast of the Glass House. When Continental moved into their new plant the new Special Products Division destined to become the Edsel Division moved into the Ford Trade School on Continental's coattails. Fittingly, on the demise of the Continental Division and dispersal of all Continental staff to other Divisions, Edsel Division moved into Continental's headquarters in November of 1956. The Division did not live on to have anything to do with the trim-bin Continental for 1958.

I only sold my services in lighting maintenance to large Corporations. I counted Ford Land a customer for many years. I serviced all of their real estate holdings, except the plants. They were easy to deal with if you did things their way. I never understood many of the things they did, and I have no formal eduction in the way Corporate America works, so I would appreciate a thorough explanation of this letter.

How/why does a company buy something it already owns?

While you're at it, explain how the billing of cars to Ford dealerships worked in 1956. I've been told that the assembly plant, or Division, was credited a dollar amount on its ledger for vehicles it shipped. It appears that dealers were billed for ordered cars by Ford Financial. They would collect what the dealer paid for the car at dealer pricing, leaving room for profit at the MSRP. My question is, was the dealer billed when the car was shipped, or when it was received? What a mess if a car like mine never showed up.

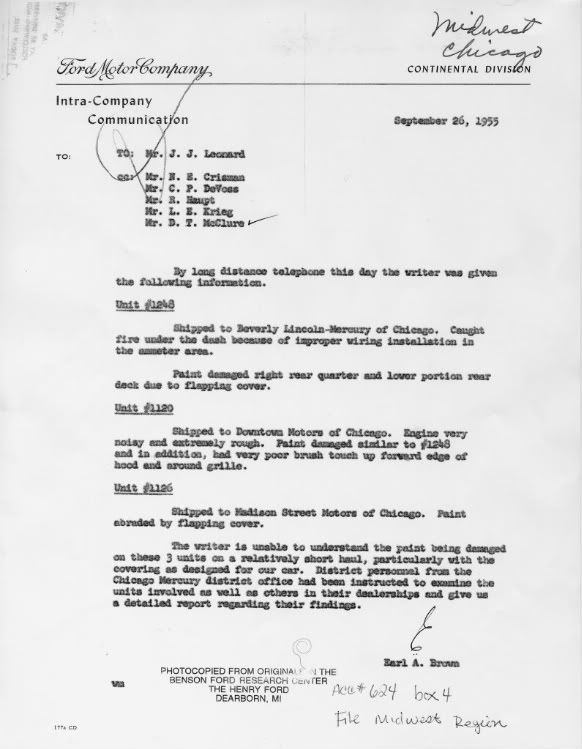

This interests me because of the letter I found in WCF's files. There was no response, that I found. I assume that once the Continental Division was paid WCF pretty-much didn't care what happened to the cars. 1248 is completely wiped clean from the record. Its Production Order in not in the files at the BFRC. It's just a WAG, but I would imagine that with the dash fire in the area of the ammeter, it would have been pretty smelly. I think the Chicago office of Continental allowed that car to cannibalized for its mechanical bits, which were in very short supply. The notes about rough running on some cars was spoken of by Elmer Rohn as leaving the problems for the skilled mechanics at the dealer's to resolve. The myth that the assembly workers were highly skilled assembly workers had no relation to their skills as mechanics. Totally different skill-sets and training. The problems were always left for the dealer and paid for by warranty claims.

1120 is a mystery, only in that the owner doesn't wish to share any information about the car. H&E said they made two convertibles, side by side. I think that the other convertible is not 1120, as it seems there were enough damaged cars that it could have been any other black car. 1126 is our car, as H & E said they made 2 for Ford Marketing, based in Chicago. How would Ford have kept track of stray inventory?

Barry Wolk

Farmington Hills, MI

C5681126

Reply With Quote

Reply With Quote

).

).